Home loan all-in financing

Home loan all-in financing

Frequently asked questions

What is a Home Loan All-in Financing?

Home Loan All-in Financing is a convenient option that will allow qualified clients to include upfront bank fees as part of their loanable amount and made payable throughout the loan term.*

*Mortgage Redemption Insurance (MRI) and Fire Insurance premiums are only included in the first year’s monthly amortization.

Who can apply for a Home Loan All-In Financing?

Anyone can apply for the Home Loan All-in Financing provided they meet the eligibility and document requirements for a Housing Loan. Make sure to inform your loan account officer that you are interested to avail of this financing option.

How will I know if I qualify for Home Loan All-In Financing?

All-in-financing includes all your upfront bank fees to form part of your approved loanable amount. If the approved loanable amount is fully consumed for your home purchase. renovation etc., then you cannot avail of this financing option.

What bank fees and charges can be included in the Home Loan All-in Financing?

The following fees and charges are included in the Home Loan All-in Financing loan amount:

-

Documentary Stamp Tax on Real Estate Mortgage (REM) and Promissory Note (PN)

-

Mortgage Registration Fees

-

Notarial Fees on Real Estate Mortgage (REM) and Promissory Note (PN)

-

Processing Fees

-

Cancellation Fees

-

Mortgage Redemption Insurance premium for the first year

-

Fire Insurance Premium for the first year

Appraisal fees are not included and must be paid upon submitting your home loan application, if applicable.

How does All-in Financing work?

No need to pay bank fees at the start of your home loan. Bank fees will be automatically included in your monthly loan amortization and spread out over the term of the loan.*

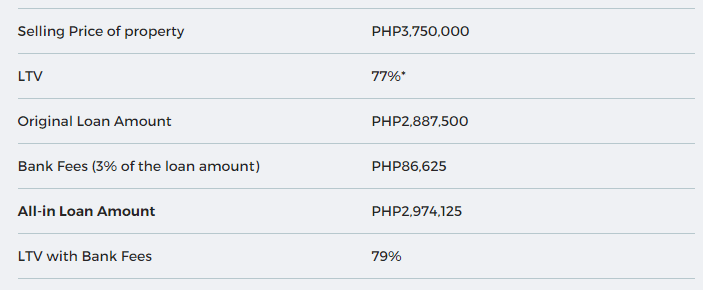

The HOME LOAN ALL-IN FINANCING LOAN AMOUNT shall be equal to the original loan amount plus all computed bank fees.

Below is a sample illustration of a housing loan under Home Loan All-In Financing:

*Maximum LTV or Loan to Value is up to 90%. Standard loan to value applies depending on the borrower, the collateral, and intended use.

What happens if the All-In Financing loan amount is insufficient to pay for the bank fees?

The Borrower will shoulder the difference in the bank fees. Clients can pay for the difference over the counter at any Security Bank branch.

TO KNOW MORE ABOUT THIS KINDLY CONTACT

iamdrivenmaica@gmail.com

09760077327 (viber)

0 Likes0 Replies-

Bank Home Loan Assistance

Active

Priority Assistance

₱ 580,000

For Sale Townhouse

2 Bedrooms 1 Bathroom 30 sqm.

Naic Cavite

Active

Priority Assistance

₱ 8.50 million

For Sale Ready For Occupancy Residential Condo

2 Bedrooms 1 Bathroom 105 sqm.

Clark Angeles Pampanga

Active

Priority Assistance

₱ 13.0 million

For Sale Pre-Selling Condotel

Studio 1 Bathroom 36 sqm.

San Juan Batangas

Active

Priority Assistance

₱ 9.00 million

For Sale Office Condo

1 Bedroom 1 Bathroom 22 sqm.

Manila Bay Pasay

Active

Priority Assistance

₱ 116,400/month

For Long Term Lease Office Space

Makati

Active

Priority Assistance

₱ 10.6 million

For Sale Pre-Selling Single Detached House

5 Bedrooms 3 Bathrooms 110 sqm.

Bacoor Cavite

Active

Priority Assistance

₱ 5.90 million

For Sale Single Detached House

3 Bedrooms 3 Bathrooms 76 sqm.

San Fernando Pampanga

Active

Priority Assistance

₱ 5.75 million

For Sale Residential Condo

Studio 1 Bathroom 23 sqm.

Pasay

Active

Priority Assistance

₱ 69.8 million

For Sale Pre-Owned House and Lot

5 Bedrooms 5 Bathrooms 410 sqm.

Alabang Muntinlupa

Active

Priority Assistance

₱ 5.50 million

For Sale Residential Condo

Studio 1 Bathroom 22 sqm.

Quezon City

Active

Priority Assistance

₱ 475,000/month

For Long Term Lease Building

Ortigas Pasig

Active

Boosted

₱ 4.80 million

For Sale Single Attached House

3 Bedrooms 2 Bathrooms 80 sqm.

Clark Angeles Pampanga